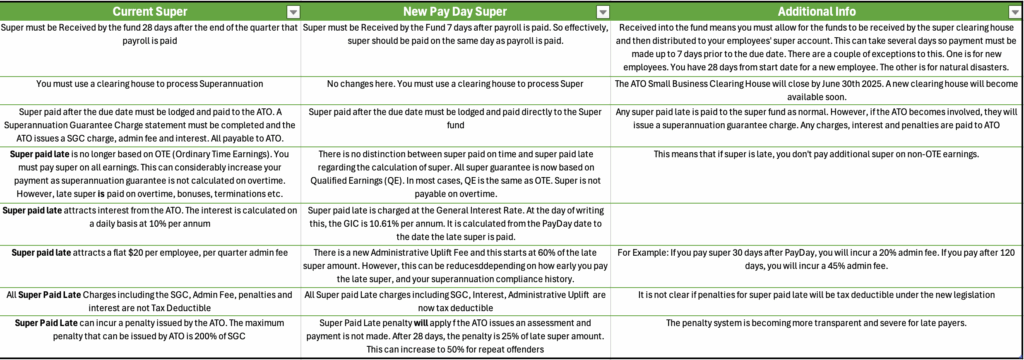

PayDay Super will be rolling out July 1st 2026. This will be a huge change for Australian Employers. Freshly legislated, the rules are complex. To enable employers to prepare, we have outlined some of the biggest changes to expect.

The large accounting payroll platforms have all confirmed they will be ready to implement PayDay Super within the software by the required Date. Xero have already implemented this. You may start using PayDay Super now if you choose.

Be mindful of the cashflow impact this will have on your business. Paying Super with payroll will take more cash out of your business on a weekly basis that may have been postponed to monthly or quarterly. The ATO realise this and are advising businesses to prepare now for the beginning of PayDay Super.

If you have any questions, reach out. Please read full ATO article for more information

Quick links

Copyright © 2024 Bookkeeping Relief. All Rights Reserved. Created by Web Host Wizards.