Are your business accounts processed on a desktop computer or are they ‘in the cloud’? Now that the ATO have legislated all Australian employers must lodge their payroll via Single Touch Payroll (STP), businesses using desktop accounting are feeling the pressure to move to the cloud. So, what is involved and how is this best done?

What is Cloud Accounting?

Rather than storing your business accounts on a desktop computer, in excel, written in books or on a server, your accounts are processed and stored on an online server that encrypts your data and sends and receives your information over the internet.

You are able to access that information from any computer or device using your login details anywhere in the world. You may give your accountant or colleagues access to this data also.

Data is sent and received very quickly and the speed is dependent on your internet connection and server performance of the accounting system rather than your own computer hardware.

How Safe can it be?

Sending data over the internet can have its risks. Many people fear their data could be lost if the remote server goes down or is hacked. While this is true, accounting system software providers, to mitigate liability, ensure this doesn’t happen by providing backup servers, two step authentication, data encryption, SSL certification and more. Due to the increased awareness of security over the internet, in some ways your data can be considered safer than traditional data storage methods.

Storing your data on a desktop computer can be risky. The data must be backed up regularly and stored externally. If the office were to catch fire and the computer with the backup is destroyed, there may be no further backups. Backups may also fail at the point of restoration (this has happened to everyone at some point). Desktop accounting data is susceptible to data corruption which can be costly and sometimes, unable to rectify. Some businesses back up and store their data on an internal server which is also costly to run and must be maintained. If the server hard drive fails, the data may be destroyed.

If you use excel or paper books to record your accounting information, the risks are even higher.

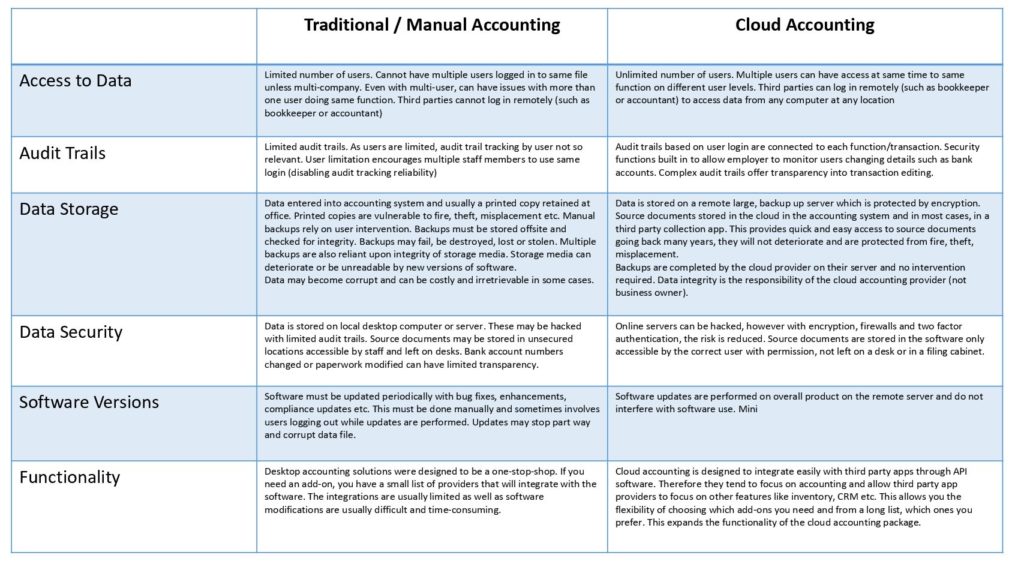

Which Desktop Problems are Solved with Cloud Accounting?

One of the main reasons cloud accounting has been picked up quicker by Australian businesses than most other countries is we have some of the first and best cloud accounting solutions available.

Here are just a few of the problems with traditional accounting that have been solved with Cloud Accounting:

How do I Choose the Right Cloud Accounting System?

The best accounting system for any business is in the cloud. The ATO are moving to the cloud and bit by bit, they have been moving their compliance to the cloud. Where once we received quarterly paper BAS statements, we now receive and lodge these digitally. This is true for IAS, TPAR, tax returns etc.

Of the main accounting packages available, the right one for your business will depend on a few factors:

- Do you intend to do your own bookkeeping or outsource?

- Which accounting system does your accountant prefer?

- Which features / add-ons will you need?

Subscription cost should never be a factor as one package may cost you $15 per month, and take longer to use and have less features than one that costs you $70 per month.

Your business is too valuable to invest in the wrong product. After all, you will probably use it for many years.

Should I do the Conversion and Setup of New Software Myself or Outsource?

In our experience, unless the business owner has advisor experience in the software, those that do the conversion and setup themselves often run into trouble. In many cases, the cost to correct errors in the new software costs as much, or more than the cost of outsourcing the task in the first place.

A client converted from a desktop accounting system to cloud recently. They used a conversion service and called us when they had completed the conversion. The conversion company had run the conversion correctly, however, the data in the desktop version was incorrect and therefore, the converted data was also incorrect. We needed to start again with this file and convert across account balances and bank accounts.

It may seem easy and software providers often advertise how easy their product is to convert to and setup. With accounts management there is a lot to consider such as correct GST settings, payroll settings, invoice layouts, chart of accounts, bank feeds etc.

We strongly encourage business owners to seek help converting and/or setting up their new software in the cloud. A professional will not only set up correctly, they know how to ensure your accounts are correct and will give you training so you know how to use your new software the best way possible.

Contact us for a free assessment and quote to help you move to the cloud

Once you take the leap to the cloud and are no longer tied to the office, you’ll find a whole new world of opportunity open up for your business